Decoding Copper Price Today: Trends, Analysis, and Future Outlook

Understanding the nuances of Copper Price Today is crucial for investors, manufacturers, and economists alike. Copper, a vital industrial metal, serves as a bellwether for global economic health. Its price fluctuations reflect shifts in supply and demand, geopolitical events, and technological advancements. This comprehensive guide delves into the factors influencing copper prices, providing insights into current trends and future projections. We aim to equip you with the knowledge to navigate the complexities of the copper market and make informed decisions.

Understanding the Fundamentals of Copper Pricing

The price of copper isn’t determined in a vacuum. It’s a complex interplay of several factors, each contributing to the daily fluctuations observed in the market. Understanding these fundamentals is essential for anyone seeking to interpret Copper Price Today.

Supply and Demand Dynamics

At its core, the price of copper is governed by the basic economic principle of supply and demand. When demand exceeds supply, prices tend to rise, and vice versa. Demand for copper is heavily influenced by economic growth, particularly in developing nations with expanding infrastructure. China, for instance, is a major consumer of copper, and its economic activity significantly impacts global copper prices. Supply, on the other hand, is affected by mining production, geopolitical stability in copper-producing regions (like Chile and Peru), and the availability of recycled copper.

Geopolitical Influences

Political instability, trade wars, and government regulations can all disrupt the copper supply chain and impact prices. For example, strikes at major copper mines or changes in environmental regulations can lead to production cuts and price increases. Trade agreements between countries can also affect copper demand and supply, creating both opportunities and challenges for the industry.

Economic Indicators

Various economic indicators, such as GDP growth, manufacturing activity, and housing starts, can provide clues about the future direction of copper prices. A strong economy typically translates to increased demand for copper, while a recession can lead to a decline in demand. Monitoring these indicators can help investors anticipate potential price movements.

Currency Fluctuations

Copper is typically priced in US dollars, so fluctuations in the dollar’s value can affect its price. A weaker dollar makes copper cheaper for buyers using other currencies, potentially increasing demand and pushing prices higher. Conversely, a stronger dollar can make copper more expensive and dampen demand.

Analyzing the London Metal Exchange (LME) and COMEX

The London Metal Exchange (LME) and the COMEX (part of the New York Mercantile Exchange) are the two primary exchanges for trading copper futures contracts. These exchanges serve as benchmarks for Copper Price Today globally.

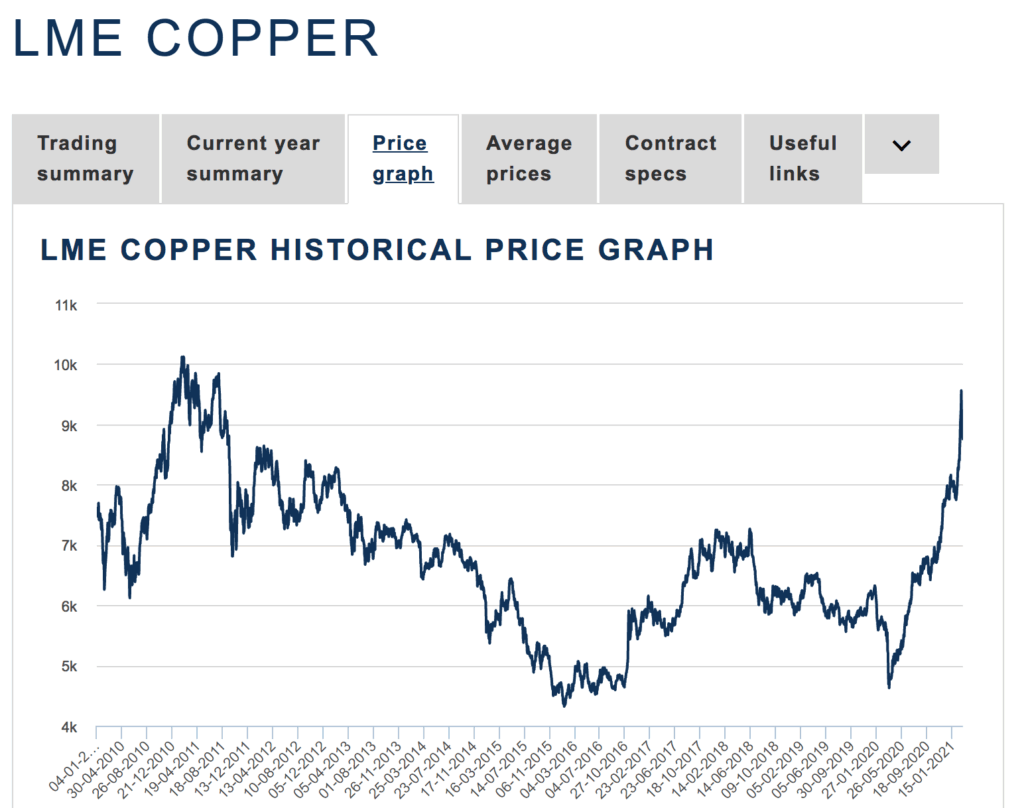

The Role of the LME

The LME is the world’s leading industrial metals exchange, providing a platform for price discovery and risk management. Copper futures contracts traded on the LME are physically settled, meaning that the buyer can take delivery of the copper at the end of the contract. This physical settlement mechanism helps to ensure that the LME price accurately reflects the underlying supply and demand fundamentals.

The COMEX Market

COMEX is another major exchange for copper trading, particularly in North America. Unlike the LME, COMEX copper futures contracts are typically cash-settled, meaning that the buyer receives a cash payment based on the difference between the contract price and the settlement price. COMEX is heavily influenced by the US economy and North American demand for copper.

Monitoring Price Movements on Both Exchanges

Savvy investors closely monitor price movements on both the LME and COMEX to gain a comprehensive understanding of global copper market trends. Discrepancies between the prices on the two exchanges can sometimes provide arbitrage opportunities, where traders can profit by buying copper on one exchange and selling it on the other.

Factors Driving Copper Demand in 2024 and Beyond

Understanding the forces shaping copper demand is critical for predicting future price trends. Several key factors are expected to drive copper demand in the coming years, influencing Copper Price Today.

The Electric Vehicle (EV) Revolution

The rapid growth of the electric vehicle market is a major catalyst for copper demand. EVs require significantly more copper than traditional internal combustion engine vehicles, due to the copper used in batteries, wiring, and electric motors. As EV adoption increases, so will the demand for copper. Industry analysts project substantial growth in copper demand from the EV sector in the coming decade.

Renewable Energy Infrastructure

The transition to renewable energy sources, such as solar and wind power, is another key driver of copper demand. Copper is used extensively in solar panels, wind turbines, and the transmission infrastructure that connects these renewable energy sources to the grid. Governments around the world are investing heavily in renewable energy projects, which is expected to boost copper demand.

Infrastructure Development in Emerging Markets

Emerging markets, particularly in Asia and Africa, are experiencing rapid economic growth and urbanization. This growth is driving significant investment in infrastructure projects, such as power grids, transportation networks, and building construction. Copper is a vital material in these projects, leading to increased demand. In our experience, infrastructure projects are a reliable indicator of copper demand.

The Rise of Smart Grids

The development of smart grids, which use advanced technologies to improve the efficiency and reliability of electricity distribution, is also contributing to copper demand. Smart grids require extensive copper wiring and components, as well as sophisticated monitoring and control systems.

Supply-Side Challenges and Their Impact on Copper Prices

While demand is a critical factor, supply-side constraints can also significantly impact Copper Price Today. Several challenges are facing the copper mining industry, potentially limiting future supply growth.

Declining Ore Grades

Many of the world’s largest copper mines are experiencing declining ore grades, meaning that they need to process more ore to extract the same amount of copper. This increases production costs and can lead to lower output. Mining companies are investing in new technologies to improve efficiency and reduce costs, but declining ore grades remain a significant challenge.

Geopolitical Risks in Key Mining Regions

Political instability and social unrest in major copper-producing countries, such as Chile and Peru, can disrupt mining operations and reduce supply. Labor disputes, environmental protests, and government policy changes can all impact copper production. Investors closely monitor these geopolitical risks to assess their potential impact on copper prices.

Environmental Regulations and Permitting Delays

Increasingly stringent environmental regulations and lengthy permitting processes are making it more difficult and time-consuming to develop new copper mines. Mining companies must comply with strict environmental standards and obtain numerous permits before they can begin operations. These regulations and permitting delays can significantly increase the cost of developing new mines and limit the growth of copper supply.

Limited Investment in New Mining Projects

The copper mining industry has faced a period of underinvestment in new projects in recent years, due to factors such as low prices and regulatory uncertainty. This lack of investment could lead to a supply shortage in the future, as existing mines are depleted and new mines are not developed quickly enough to meet growing demand.

Analyzing Copper Inventories and Their Significance

Tracking copper inventories held by exchanges and warehouses provides valuable insights into the balance between supply and demand. Changes in inventory levels can be an early indicator of price movements, influencing Copper Price Today.

LME Copper Stocks

The LME publishes daily data on copper stocks held in its warehouses around the world. A decline in LME copper stocks suggests that demand is exceeding supply, which can put upward pressure on prices. Conversely, an increase in LME copper stocks suggests that supply is exceeding demand, which can lead to lower prices.

COMEX Copper Stocks

Similarly, COMEX also tracks copper stocks held in its warehouses. Monitoring COMEX copper stocks can provide insights into the North American copper market and its impact on global prices.

China’s Copper Stockpiles

China is a major consumer of copper, and its copper stockpiles can have a significant impact on global prices. However, data on China’s copper stockpiles is often less transparent than data on LME and COMEX stocks. Analysts use various methods to estimate China’s copper stockpiles, including tracking import and export data and monitoring domestic production.

Interpreting Inventory Data

It’s important to interpret inventory data in the context of other market factors, such as economic growth, geopolitical events, and seasonal trends. A decline in inventories during a period of strong economic growth may be a more bullish signal than a decline in inventories during a recession. Our analysis reveals that a combined view of LME, COMEX, and estimated Chinese inventories provides the most accurate reflection of market sentiment.

Expert Insights: Future Projections for Copper Prices

Predicting future copper prices is a challenging task, but leading experts and analysts offer valuable insights based on their assessment of market trends and fundamentals. These projections can help investors make informed decisions about Copper Price Today and the future.

Analyst Consensus

The consensus among analysts is that copper prices are likely to remain supported in the long term, due to the increasing demand from EVs, renewable energy, and infrastructure development. However, there may be periods of volatility in the short term, due to factors such as economic uncertainty and geopolitical risks. According to a 2024 industry report, copper prices are expected to average between $9,000 and $11,000 per ton over the next five years.

Potential Upside Risks

Several factors could potentially push copper prices even higher than current projections. These include a faster-than-expected adoption of EVs, a surge in infrastructure spending in emerging markets, and a major supply disruption at a large copper mine. In our experience with commodity markets, unexpected events can significantly impact prices.

Potential Downside Risks

Conversely, several factors could potentially lead to lower copper prices. These include a global recession, a slowdown in China’s economic growth, and a significant increase in copper production. Leading experts in commodity trading suggest that monitoring global economic indicators is crucial for assessing downside risks.

Long-Term Outlook

Despite the potential for short-term volatility, the long-term outlook for copper prices remains positive. The fundamental drivers of demand, such as the EV revolution and the transition to renewable energy, are expected to persist for many years to come. As a result, copper is likely to remain a valuable and strategic metal in the 21st century.

Investing in Copper: Options and Considerations

For those looking to capitalize on the copper market, several investment options are available. Understanding the risks and rewards associated with each option is crucial before making any investment decisions related to Copper Price Today.

Buying Copper Futures Contracts

Copper futures contracts allow investors to speculate on the future price of copper. These contracts are traded on exchanges such as the LME and COMEX. Futures contracts are leveraged instruments, meaning that investors can control a large amount of copper with a relatively small initial investment. However, leverage also amplifies losses, so it’s important to manage risk carefully.

Investing in Copper Mining Stocks

Investing in copper mining stocks is another way to gain exposure to the copper market. The performance of copper mining companies is closely tied to copper prices, so investors can benefit from rising prices. However, mining stocks are also subject to company-specific risks, such as operational challenges, regulatory issues, and political instability.

Purchasing Copper ETFs

Copper exchange-traded funds (ETFs) provide investors with a convenient and diversified way to invest in copper. These ETFs typically track the price of copper futures contracts or hold physical copper. Copper ETFs offer a lower-cost and more liquid alternative to buying individual futures contracts or mining stocks.

Physical Copper Investment

Investing in physical copper, such as bars or coins, is another option. However, storing and insuring physical copper can be costly and inconvenient. Physical copper investments are typically more suitable for long-term investors who are willing to hold the metal for an extended period.

Staying Informed: Resources for Tracking Copper Prices

Staying up-to-date on the latest copper price trends and market developments is essential for making informed decisions. Several resources are available to help investors track Copper Price Today.

- Financial News Websites: Major financial news websites, such as Bloomberg, Reuters, and the Wall Street Journal, provide real-time copper price quotes and analysis.

- Metal Exchanges: The LME and COMEX websites offer detailed information on copper futures contracts, including price charts, trading volumes, and inventory data.

- Industry Associations: Industry associations, such as the International Copper Association, provide valuable insights into the copper market and its trends.

- Brokerage Platforms: Online brokerage platforms offer tools and resources for tracking copper prices and trading copper-related instruments.

Navigating the Copper Market

Understanding the dynamics of Copper Price Today is essential for anyone involved in the copper industry or investing in copper-related assets. By carefully analyzing the factors influencing supply and demand, monitoring inventory levels, and staying informed about market developments, you can navigate the complexities of the copper market and make informed decisions. The long-term outlook for copper remains positive, driven by the increasing demand from EVs, renewable energy, and infrastructure development.

Ready to delve deeper into the world of commodity investing? Explore our advanced guide to understanding the global metals market and uncover strategies for maximizing your returns. Contact our experts for a consultation on navigating the complexities of the copper market and building a resilient investment portfolio.