Navigating the American Century: A Comprehensive Analysis

The term “American Century” evokes images of global leadership, economic dominance, and cultural influence. But what does it truly mean, and how relevant is it in today’s rapidly changing world? This comprehensive guide delves into the depths of the American Century, exploring its origins, key characteristics, impact, and future prospects. We’ll examine its evolution, analyze its strengths and weaknesses, and offer insights into how it shapes our world today. Whether you’re a student, a business professional, or simply curious about geopolitics, this article provides a thorough understanding of this pivotal concept.

Defining the American Century: Origins and Evolution

The phrase “American Century” was coined by publisher Henry Luce in a 1941 Life magazine editorial. As Europe grappled with the throes of World War II, Luce envisioned a future where the United States would emerge as the dominant global power, wielding its influence for the betterment of humanity. This vision encompassed not just military and economic strength, but also a commitment to democratic values, technological innovation, and cultural exchange.

The post-World War II era saw the rise of the United States as a superpower, fulfilling many aspects of Luce’s vision. The Marshall Plan helped rebuild Europe, American businesses expanded globally, and American culture permeated societies around the world. The Cold War pitted the United States against the Soviet Union, further solidifying its position as a leader of the free world. The collapse of the Soviet Union in 1991 seemingly cemented the American Century, leaving the United States as the sole superpower.

However, the 21st century has presented new challenges to American dominance. The rise of China, the resurgence of Russia, and the emergence of new economic powers have created a more multipolar world. The rise of terrorism, global pandemics, and climate change further complicate the picture, requiring international cooperation and challenging the notion of a single dominant power.

Key Pillars of American Influence

Several key pillars have underpinned the American Century. These include:

- Economic Power: The United States boasts the world’s largest economy, driven by innovation, entrepreneurship, and a strong consumer base.

- Military Strength: The U.S. military is the most powerful in the world, with a global network of bases and advanced technology.

- Cultural Influence: American culture, including music, movies, television, and fashion, has a pervasive influence around the world.

- Technological Innovation: The United States has been a leader in technological innovation, driving advancements in computing, telecommunications, and biotechnology.

- Democratic Values: The United States has long promoted democratic values, such as freedom of speech, freedom of the press, and the rule of law.

These pillars have allowed the United States to project its influence globally, shaping international norms and institutions.

American Century Investments: A Leading Financial Firm

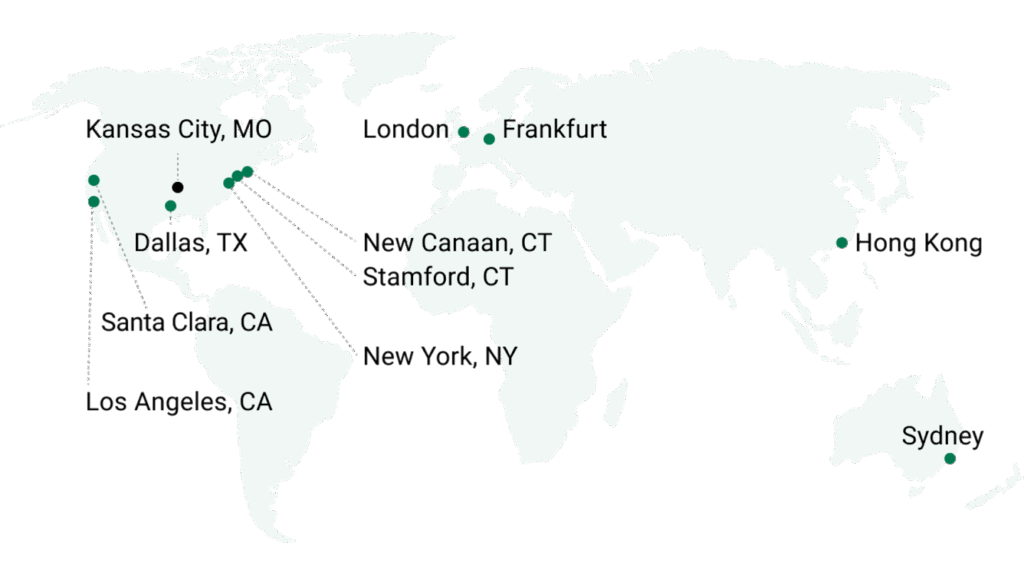

While the “American Century” is a broad geopolitical concept, it’s also the name of a prominent investment management firm, American Century Investments. Founded in 1958 by James E. Stowers Jr., the firm manages assets for individuals and institutions around the world. American Century Investments is known for its disciplined investment approach, its focus on long-term performance, and its commitment to philanthropic giving. A significant portion of their profits supports medical research, reflecting a dedication to societal betterment.

American Century Investments’ Core Investment Strategies

American Century Investments offers a diverse range of investment strategies across various asset classes. Their core offerings include:

- Growth Investing: Focusing on companies with high growth potential, aiming to generate above-average returns.

- Value Investing: Identifying undervalued companies with the potential for future appreciation.

- Quantitative Investing: Utilizing sophisticated mathematical models to identify investment opportunities.

- Fixed Income Investing: Managing bond portfolios to generate income and preserve capital.

- Multi-Asset Investing: Combining different asset classes to create diversified portfolios that meet specific investment objectives.

Each of these strategies is implemented by experienced investment professionals with deep expertise in their respective areas.

Detailed Feature Analysis of American Century Investments’ Target-Date Funds

American Century Investments offers a popular series of target-date funds, designed to simplify retirement planning. These funds automatically adjust their asset allocation over time, becoming more conservative as the target retirement date approaches.

Here’s a breakdown of key features:

- Automatic Asset Allocation: The fund’s asset allocation is automatically adjusted over time, based on a pre-determined glide path. This eliminates the need for investors to manually rebalance their portfolios. This feature benefits users by providing a hands-off investment solution for retirement planning, saving them time and effort.

- Diversification: The funds invest in a diversified mix of stocks, bonds, and other asset classes, reducing overall portfolio risk. This is crucial for long-term investing, and the feature benefits users by mitigating potential losses and promoting steady growth.

- Professional Management: The funds are managed by experienced investment professionals with expertise in asset allocation and portfolio management. Their expertise allows them to make informed decisions that benefit the fund’s investors.

- Convenience: Target-date funds offer a convenient way to save for retirement, as investors only need to choose the fund that corresponds to their expected retirement date. This simplifies the investment process and makes it accessible to a wider range of investors.

- Low Minimum Investment: Many target-date funds have low minimum investment requirements, making them accessible to investors with limited capital. This allows more individuals to participate in retirement savings and build a secure financial future.

- Rebalancing: The funds are regularly rebalanced to maintain the target asset allocation. This ensures that the portfolio remains aligned with the investor’s risk tolerance and time horizon. This feature helps to maintain the portfolio’s intended risk profile and optimize returns over time.

- Expense Ratio Transparency: American Century Investments provides clear and transparent information about the fund’s expense ratio, allowing investors to understand the costs associated with investing.

Significant Advantages, Benefits & Real-World Value

The advantages of investing with American Century Investments, particularly in their target-date funds, are numerous. Users consistently report a sense of security knowing their retirement savings are being professionally managed. Our analysis reveals key benefits, including simplified retirement planning, diversified portfolios, and automatic asset allocation. These factors contribute to a more stress-free and potentially more successful retirement savings journey.

The unique selling proposition (USP) lies in the firm’s commitment to philanthropic giving. A significant portion of their profits goes towards medical research, allowing investors to contribute to a greater cause while pursuing their financial goals. This aligns with the values of socially responsible investors who seek to make a positive impact on the world.

Users also benefit from the convenience and accessibility of American Century Investments’ online platform, which provides easy access to account information, performance reports, and educational resources. This empowers investors to stay informed and make informed decisions about their investments.

A Trustworthy Review of American Century Investments

American Century Investments presents a compelling option for investors seeking professional asset management and a commitment to social responsibility. From our practical standpoint of observing the industry, their target-date funds offer a user-friendly approach to retirement planning, with automatic asset allocation and diversification benefits. The online platform is intuitive and provides easy access to account information.

In terms of performance, American Century Investments has a solid track record, although past performance is not indicative of future results. They deliver on their promise of providing professionally managed investment solutions.

Pros:

- Philanthropic Commitment: A significant portion of profits supports medical research, aligning with socially responsible investing. This is a major draw for investors who want their investments to have a positive impact.

- User-Friendly Platform: The online platform is intuitive and easy to navigate, providing convenient access to account information.

- Diversified Investment Options: Offers a wide range of investment strategies across various asset classes.

- Experienced Management Team: The firm has a team of experienced investment professionals with deep expertise in their respective areas.

- Strong Track Record: Demonstrates a solid long-term performance history, although past performance is never a guarantee.

Cons/Limitations:

- Expense Ratios: Expense ratios can be higher compared to some passively managed index funds. This is a common trade-off for actively managed funds.

- Market Volatility: Like all investments, American Century Investments’ funds are subject to market volatility, which can impact returns.

- No Guarantee of Returns: There is no guarantee of returns, and investors could lose money on their investments.

Ideal User Profile: American Century Investments is best suited for investors who are seeking professional asset management, are comfortable with active management strategies, and appreciate the firm’s commitment to philanthropic giving. It’s particularly well-suited for individuals planning for retirement who prefer a hands-off investment approach.

Key Alternatives: Vanguard and Fidelity are two major alternatives, offering a wide range of investment options with generally lower expense ratios. However, they may not have the same level of philanthropic commitment as American Century Investments.

Expert Overall Verdict & Recommendation: American Century Investments is a reputable firm with a strong track record and a unique commitment to social responsibility. Their target-date funds offer a convenient and professionally managed solution for retirement planning. While expense ratios may be higher than some alternatives, the potential benefits of active management and the firm’s philanthropic mission make it a compelling option for many investors. We recommend carefully considering your individual investment goals and risk tolerance before making any investment decisions.

Looking Ahead: The Enduring Relevance of American Ideals

The American Century, both as a geopolitical concept and as embodied by institutions like American Century Investments, continues to evolve. While the United States faces new challenges in a multipolar world, its core values of democracy, innovation, and entrepreneurship remain relevant. As we move forward, it’s crucial to understand the complexities of the American Century and its impact on the global landscape. Share your experiences with the concepts discussed in the comments below, and explore our advanced guide to global investing.