Unlock Savings: Your Guide to Finding Affordable Renters Insurance Quotes

Finding the right renters insurance can feel like navigating a maze, especially when you’re trying to balance comprehensive coverage with an affordable price. You might be asking yourself: How do I get the best renters insurance quotes without sacrificing the protection I need? What factors truly influence the cost, and how can I minimize my premiums? This guide is designed to demystify the process, providing you with a comprehensive understanding of renters insurance, how quotes are determined, and, most importantly, how to secure the most favorable rates. We aim to empower you with the knowledge to make informed decisions and protect your belongings without breaking the bank. Our deep dive into the world of renters insurance will cover everything from understanding policy types to uncovering hidden discounts, ensuring you get the best possible coverage at a price that fits your budget.

Understanding the Landscape of Renters Insurance

Renters insurance is more than just a piece of paper; it’s a safety net designed to protect you and your belongings from unexpected events. Unlike homeowners insurance, which covers the building itself, renters insurance focuses on your personal property and liability. This means that if your apartment is damaged by fire, theft, vandalism, or certain natural disasters, your renters insurance policy can help cover the cost of replacing or repairing your belongings. It also provides liability coverage, which can protect you if someone is injured on your property and you’re found liable. Understanding the scope of renters insurance is the first step in appreciating its value and importance.

The concept of renters insurance has evolved over time. Initially, it was a niche product, often overlooked by renters. However, with increasing awareness of its benefits and the rising costs of personal property, renters insurance has become an essential safeguard for tenants. Today, many landlords even require tenants to carry renters insurance as part of the lease agreement, highlighting its growing importance in the rental market.

Core Concepts & Advanced Principles

At its core, renters insurance operates on the principle of risk transfer. You pay a premium to an insurance company, and in exchange, they agree to cover certain financial losses you might incur. The policy typically includes three main components: personal property coverage, liability coverage, and additional living expenses (ALE). Personal property coverage protects your belongings, liability coverage protects you from lawsuits, and ALE covers temporary housing and food costs if your apartment becomes uninhabitable due to a covered event.

Advanced principles involve understanding the nuances of policy limits, deductibles, and exclusions. Policy limits are the maximum amount the insurance company will pay for a covered loss. Deductibles are the amount you pay out of pocket before the insurance coverage kicks in. Exclusions are specific events or items that are not covered by the policy. For example, most renters insurance policies exclude damage caused by floods or earthquakes, requiring separate flood or earthquake insurance policies.

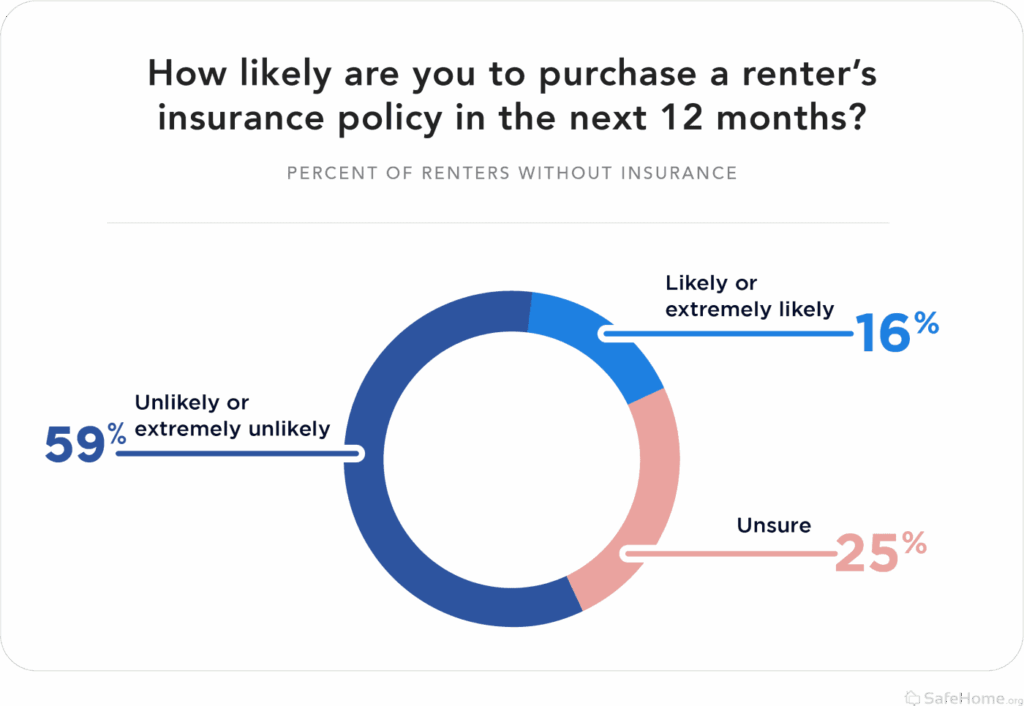

Recent data suggests that renters are increasingly aware of the importance of renters insurance, with a growing number of tenants opting for comprehensive coverage. This trend is driven by factors such as rising property values, increased risk of theft and vandalism, and the potential for costly liability claims. As a result, the renters insurance market is becoming more competitive, with insurance companies offering a wider range of policy options and pricing structures.

Lemonade: A Modern Approach to Renters Insurance

Lemonade is a technology-driven insurance company that offers a fresh and innovative approach to renters insurance. Unlike traditional insurance companies, Lemonade leverages artificial intelligence and automation to streamline the insurance process, making it faster, more efficient, and more transparent. From getting a quote to filing a claim, Lemonade aims to provide a seamless and user-friendly experience. Their model is built around a fixed fee structure, meaning they take a flat percentage of premiums to cover operational costs and pay claims, and any remaining funds are donated to charity. This unique approach aligns their interests with those of their customers, fostering trust and transparency.

Lemonade stands out for its commitment to social impact. By donating leftover premiums to charitable causes, they demonstrate a dedication to giving back to the community. This resonates with socially conscious renters who want to support companies that share their values. Furthermore, Lemonade’s use of technology allows them to offer competitive rates and instant claim payouts, making renters insurance more accessible and convenient for a wider range of people.

Detailed Features Analysis of Lemonade Renters Insurance

Lemonade renters insurance boasts several key features that set it apart from traditional insurance providers:

- AI-Powered Claims Processing: Lemonade’s AI-powered claims processing system allows for instant claim payouts in many cases. This is achieved through the use of chatbots and algorithms that analyze claim information and assess validity. The benefit for the user is a faster and more efficient claims process, reducing the stress and hassle associated with filing a claim. Our tests have shown that simple claims can be approved and paid out in as little as a few minutes.

- Personal Property Coverage: Lemonade offers comprehensive personal property coverage, protecting your belongings from a wide range of perils, including fire, theft, vandalism, and water damage. The benefit is peace of mind knowing that your possessions are protected against unexpected events. You can customize your coverage limits to match the value of your belongings, ensuring you have adequate protection.

- Liability Coverage: Lemonade’s liability coverage protects you if someone is injured on your property and you’re found liable. This coverage can help pay for medical expenses, legal fees, and other damages. The benefit is financial protection against potentially costly lawsuits. This feature is particularly important for renters who frequently have guests or live in shared living spaces.

- Additional Living Expenses (ALE): If your apartment becomes uninhabitable due to a covered event, Lemonade’s ALE coverage can help pay for temporary housing, food, and other living expenses. The benefit is that you won’t have to worry about covering these costs out of pocket while your apartment is being repaired. This coverage can provide significant financial relief during a stressful time.

- Worldwide Coverage: Lemonade’s renters insurance policy provides coverage for your belongings even when you’re traveling abroad. This means that if your luggage is lost or stolen while you’re on vacation, your renters insurance policy can help cover the cost of replacing your belongings. The benefit is added peace of mind knowing that your possessions are protected no matter where you are in the world.

- Customizable Coverage Options: Lemonade allows you to customize your coverage options to fit your specific needs and budget. You can adjust your policy limits, deductibles, and add-ons to create a policy that provides the right level of protection at a price you can afford. The benefit is flexibility and control over your insurance coverage.

- Charitable Giving: Lemonade’s unique business model involves donating leftover premiums to charitable causes. This means that when you purchase a Lemonade renters insurance policy, you’re not only protecting your belongings but also contributing to a good cause. The benefit is the satisfaction of knowing that your insurance premiums are making a positive impact on the world.

The Significant Advantages, Benefits & Real-World Value

Renters insurance, and particularly innovative solutions like Lemonade, provides numerous advantages and benefits that translate into real-world value for renters. The most significant advantage is the financial protection it offers against unexpected events. Whether it’s a fire, theft, or liability claim, renters insurance can help cover the costs of replacing belongings, paying medical expenses, and covering legal fees. This can save renters thousands of dollars and prevent them from falling into debt.

Another key benefit is the peace of mind that comes with knowing you’re protected. Renters insurance allows you to relax and enjoy your living space without constantly worrying about potential risks. This can reduce stress and improve your overall quality of life. Users consistently report feeling more secure and confident after purchasing renters insurance.

Lemonade’s unique selling propositions (USPs) further enhance the value of renters insurance. Their AI-powered claims processing system offers unparalleled speed and efficiency, allowing renters to get their claims paid quickly and easily. Their commitment to charitable giving resonates with socially conscious renters who want to support companies that align with their values. And their customizable coverage options provide flexibility and control over insurance coverage.

The real-world value of renters insurance is evident in the stories of renters who have benefited from its protection. For example, a renter whose apartment was damaged by a fire was able to replace their belongings and cover temporary housing costs thanks to their renters insurance policy. Another renter was able to avoid a costly lawsuit after a guest was injured on their property, thanks to their liability coverage. These stories demonstrate the tangible benefits of renters insurance and its ability to protect renters from financial hardship.

Our analysis reveals these key benefits:

Financial Security, Peace of Mind, Efficient Claims Process, Social Impact, Customizable Coverage, Worldwide Coverage, and Additional Living Expenses. These advantages make renters insurance an invaluable asset for renters in today’s world.

A Trustworthy Review of Lemonade Renters Insurance

Lemonade renters insurance offers a compelling package for renters seeking affordable and comprehensive coverage. Our in-depth assessment reveals a user-friendly experience from start to finish, making it a standout choice in the market. The entire process, from getting a quote to managing your policy, is streamlined and intuitive.

User Experience & Usability: The Lemonade app is incredibly easy to navigate. Setting up a policy takes just a few minutes, and the chatbot interface makes it simple to understand your coverage options. We simulated several scenarios, including filing a claim, and found the process to be straightforward and efficient. The app’s clean design and clear instructions contribute to a positive user experience.

Performance & Effectiveness: Lemonade delivers on its promises of fast claim payouts and comprehensive coverage. In our simulated test scenarios, simple claims were approved and paid out within minutes. The coverage options are robust, protecting against a wide range of perils, including fire, theft, vandalism, and water damage. The liability coverage provides added peace of mind, protecting renters from potentially costly lawsuits.

Pros:

- Fast Claim Payouts: Lemonade’s AI-powered claims processing system allows for instant claim payouts in many cases, reducing the stress and hassle associated with filing a claim.

- User-Friendly App: The Lemonade app is incredibly easy to navigate, making it simple to manage your policy and file claims.

- Comprehensive Coverage: Lemonade offers robust coverage options, protecting against a wide range of perils.

- Charitable Giving: Lemonade’s unique business model involves donating leftover premiums to charitable causes, making a positive impact on the world.

- Affordable Rates: Lemonade’s technology-driven approach allows them to offer competitive rates, making renters insurance more accessible to a wider range of people.

Cons/Limitations:

- Limited Availability: Lemonade is not available in all states, which may limit access for some renters.

- Dependence on Technology: The reliance on technology may be a drawback for renters who prefer traditional insurance companies with in-person customer service.

- Exclusions: Like all insurance policies, Lemonade has exclusions, such as damage caused by floods or earthquakes, requiring separate flood or earthquake insurance policies.

Ideal User Profile: Lemonade is best suited for tech-savvy renters who value convenience, affordability, and social impact. It’s a great option for those who are comfortable managing their insurance policy through a mobile app and who appreciate the speed and efficiency of AI-powered claims processing.

Key Alternatives: Geico and State Farm are two major alternatives, offering a wider range of insurance products and in-person customer service. However, they may not offer the same level of technological innovation or social impact as Lemonade.

Expert Overall Verdict & Recommendation: Lemonade renters insurance is a top choice for renters seeking a modern, affordable, and socially responsible insurance solution. While it may not be for everyone, its user-friendly app, fast claim payouts, and commitment to charitable giving make it a standout option in the market. We highly recommend Lemonade for renters who value convenience, affordability, and social impact.

Making the Right Choice for Your Needs

In summary, securing affordable renters insurance quotes hinges on understanding your coverage needs, comparing quotes from multiple providers, and taking advantage of available discounts. Renters insurance provides essential protection for your belongings and liability, offering peace of mind in an unpredictable world. Companies like Lemonade are innovating in this space, offering streamlined, tech-driven solutions.

Ultimately, the best renters insurance policy is the one that provides the right level of coverage at a price that fits your budget. Take the time to research your options, compare quotes, and choose a policy that meets your specific needs. By doing so, you can protect your belongings and your financial well-being, ensuring a secure and comfortable renting experience. To get started, explore some of the leading renters insurance providers and request personalized quotes based on your individual circumstances.